Introduction: Aptos Labs is committed to developing products and applications on the Aptos blockchain that redefine the web3 user experience1. The team of accomplished technical experts is dedicated to creating better network tooling and seamless usability to bring the benefits of decentralization to the masses.

Business Model: Aptos Labs has raised $200 million in a strategic round led by a16z crypto with participation from Multicoin Capital, Katie Haun, ParaFi Capital, IRONGREY, Hashed, Variant, Tiger Global, BlockTower, FTX Ventures, Paxos and Coinbase Ventures. The funding will be used to grow the team and support the companies, brands and builders who are eager to build on Aptos.

Airdrop Details: Aptos Labs conducted an airdrop where a total of 23,454,750 APT tokens were distributed to 124,828 participants. This means that on average each unique wallet received approximately 188 APT tokens. The airdrop was aimed at users who completed an application for an Aptos Incentivized Testnet or users who minted an APTOS:ZERO testnet NFT.

Token Value As of now, the current price of APT token is approximately $5.304. Therefore, the average worth of airdropped tokens per wallet is approximately $996.4 (188 APT * $5.30).

Conclusion: Aptos Labs has positioned itself as a key player in the web3 space with its unique approach to blockchain technology and community engagement. The successful airdrop and strategic funding round highlight the project’s potential and its commitment to fostering a robust ecosystem.

Conclusion: Aptos Labs has positioned itself as a key player in the web3 space with its unique approach to blockchain technology and community engagement. The successful airdrop and strategic funding round highlight the project’s potential and its commitment to fostering a robust ecosystem.

Blur.io Analysis: https://medium.com/blockchain-at-usc/blur-io-analysis-4bf374265a4f

Executive Summary: Blur.io is an NFT marketplace for professional traders that was launched in October 2022. It has quickly gained popularity and has become one of the top NFT marketplaces on Ethereum, surpassing OpenSea in terms of sales volume. Blur.io aims to build a fair and community-driven platform for NFT traders and collectors. It offers a range of features such as low fees, high speed, and NFT floor depth charts that are trader-friendly. The platform also has its own lending protocol called Blend, which allows users to lend their NFTs.

Introduction: Blur.io is an NFT marketplace that was launched in October 2022. It is designed for professional traders and has quickly become one of the top NFT marketplaces on Ethereum. Blur.io aims to build a fair and community-driven platform for NFT traders and collectors.

Background: Blur.io is an NFT marketplace that was launched in October 2022. It is designed for professional traders and has quickly become one of the top NFT marketplaces on Ethereum. Blur.io aims to build a fair and community-driven platform for NFT traders and collectors.

Problem Statement: The problem that Blur.io aims to solve is the lack of a fair and community-driven platform for NFT traders and collectors.

Analysis: Blur.io offers a range of features such as low fees, high speed, and NFT floor depth charts that are trader-friendly. The platform also has its own lending protocol called Blend, which allows users to lend their NFTs.

Solution: Blur.io aims to build a fair and community-driven platform for NFT traders and collectors. It offers a range of features such as low fees, high speed, and NFT floor depth charts that are trader-friendly. The platform also has its own lending protocol called Blend, which allows users to lend their NFTs.

Results: Blur.io has quickly become one of the top NFT marketplaces on Ethereum, surpassing OpenSea in terms of sales volume. The platform is trusted and backed by Paradigm 6529 Zeneca Egirl Capital. In Season 1, Blur.io distributed 360,000,000 BLUR tokens to the community worth around $66,888,000 today for an average of around $600 per unique wallet. Season 2 has now begun, and users can start listing and bidding on Blur to get started on Season 2 rewards.

Conclusion: Blur.io is an NFT marketplace that was launched in October 2022. It is designed for professional traders and has quickly become one of the top NFT marketplaces on Ethereum. Blur.io aims to build a fair and community-driven platform for NFT traders and collectors.

The rise of Uniswap begins with Ethereum. Back in 2016, the price of Ethereum was trading between $1.00 and $20.00 as the protocol received its first shimmer of public attention. Ethereum was one of those ideas that made people inexplicably excited because they knew it was going to have a societal impact in ways unfathomable at the time.

Ethereum’s vibrant community consisted primarily of idealistic, tech-savvy libertarians. For the early community, this technology served as more than an instrument of utility; it was an instantiation of their ideology. Ethereum ushered in a revolution by creating the first decentralized, permissionless, and trustless computation network.

Ideological reverence aside, Ethereum suffered plenty of issues in its infancy. One major challenge was the critical role that centralized exchanges played in the Ethereum ecosystem. Liquidity consolidated under these exchanges in a centralized and restricted format, presenting a bottleneck for decentralization and preventing Ethereum from truly embodying its underlying philosophy.

Naturally, the idea of a decentralized exchange (DEX) was proposed as a solution to this, but the mechanics of an effective one were not yet articulated.

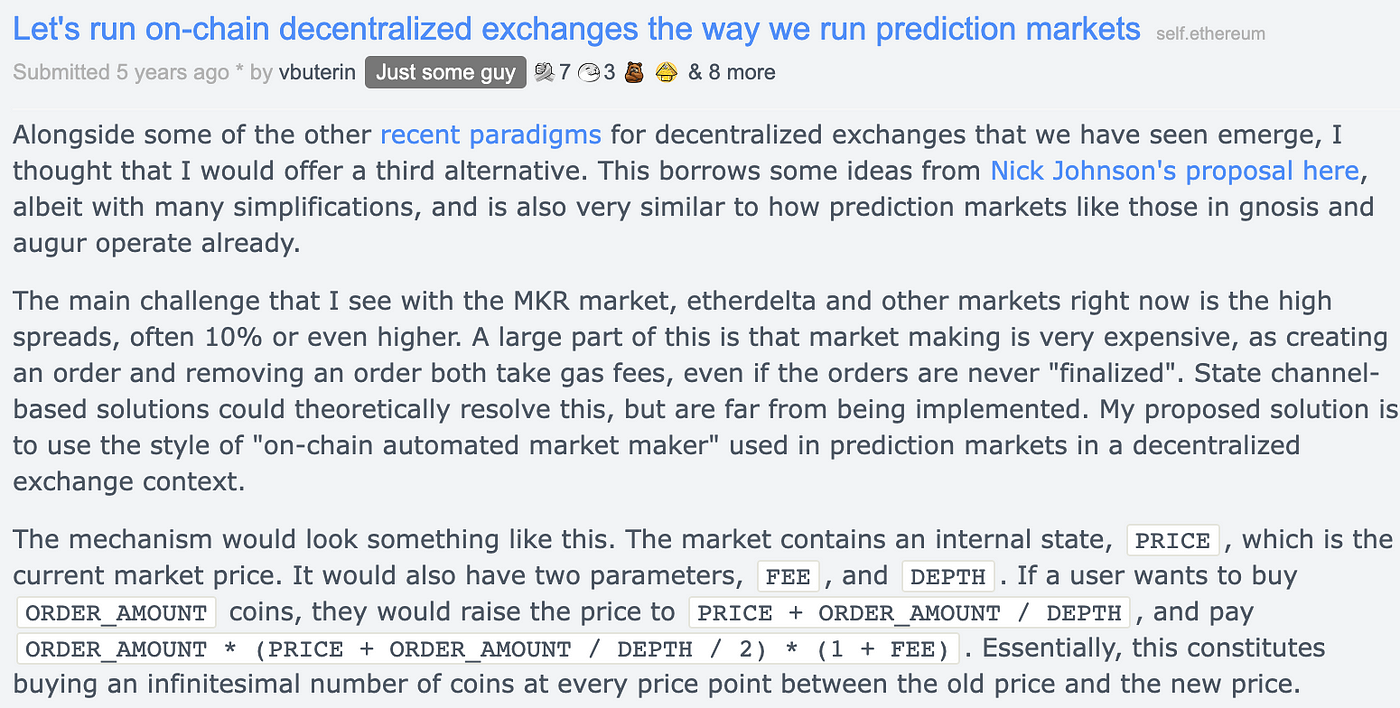

To create a DEX one could not use the same order-book architecture as centralized exchanges. Instead, a DEX needed to aggregate the liquidity for trades in pools, thereby decreasing transaction costs (i.e., gas fees) and reducing the spread between bid and ask prices. In 2016, a post by reddit user “vbuterin” explained how these DEX features could be accomplished through a structure he called an “on-chain Automated Market Maker” (AMM).

Vitalik Buterin’s proposal to create an on chain-AMM.

The post largely sat idle until catching the eye of Uniswap founder, Hayden Adams. Intrigued by Vitalik’s idea, Adams began developing a decentralized AMM protocol which would eventually become Uniswap.

Uniswap V1.

On November 2, 2017, the first version of Uniswap (V1) was deployed on Ethereum. Users expressed overwhelming support and adopted the Uniswap model at a rapid pace. Uniswap lived entirely on the Ethereum blockchain in the form of smart contracts. It had a simple design interface that served one purpose: permissionless, decentralized, and trustless trading. Uniswap’s incredible success gained the platform critical acclaim, and the architecture became the standard model for DEXs that followed.

The Automated Market Maker

The main achievement of Uniswap V1 was creating an effective decentralized exchange that used an Automated Market Maker to facilitate trades. The traditional order book model employed by centralized exchanges presupposes a trusted party and a high-bandwidth protocol to facilitate efficient trades.

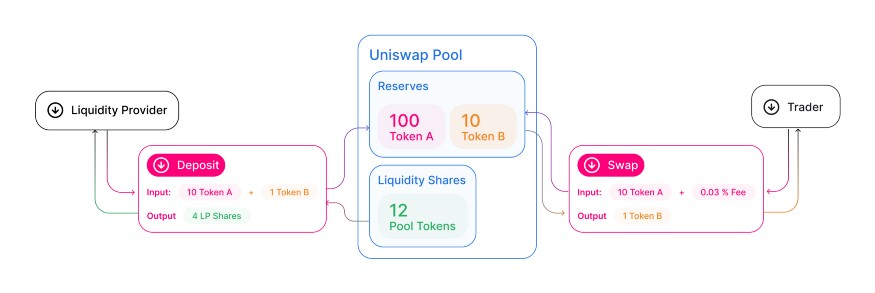

A decentralized exchange needs an architecture that can make trades dynamically as traders submit them. As hinted at above, the solution is to aggregate the liquidity needed to make trades in a single “liquidity pool.” And, as long as liquidity in the pool is deep enough, the protocol can offer a trustless, decentralized, and permissionless exchange of assets.

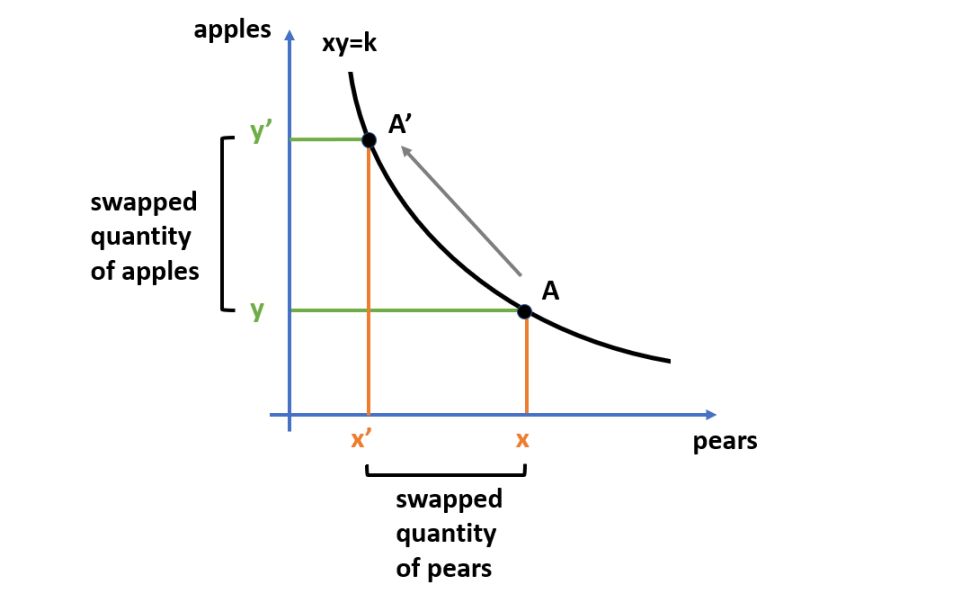

The exchange rate of the assets is given by their relative abundance to one another in the pool. As the relative abundance of one of the assets changes, the price to swap from one asset to another adjusts accordingly. This can be summarized abstractly as “xy = k”, where “x” and “y” are the assets, and “k” is the liquidity pool’s aggregate value.

(Above) Swapping along the curve “x * y = k”

V1 liquidity pools were initially composed through a commitment of a 50:50 split of ETH and any ERC20 token for a pair such as 1 ETH paired to 2,500 USDC. This liquidity would then be aggregated into a single pool for the two assets. In our example above the pool would look like: “ETH / USDC.” Each trade that happened in this pool would incur a 0.3% trading fee that’s distributed proportionally to the pool’s Liquidity Providers (LPs).

Traditional order book exchanges can be difficult to scale in a decentralized form because they don’t properly incentivize the addition of liquidity nor trading activity. Incentivizing individuals to provide liquidity creates early adoption incentives that facilitate the creation of token pairs that have liquidity proportional to the extent that the market deems it reasonable.

Liquidity providing was a novel form of passive income generation that generated a lot of buzz in the early Decentralized Finance (DeFi) space. Many were excited to have an alternative avenue to earn passive yield, but this was not without risk. For starters, smart contracts could be “hacked” resulting in loss of funds. In addition, a phenomenon known as impermanent loss began to emerge as a potential pitfall of providing liquidity.

Impermanent loss (sometimes called unrealized loss) refers to the situation where one and/or both of the tokens you deposited has a significant price change. As a result, the holder becomes worse off following the swap than if you simply held both assets. Impermanent loss can happen because the Uniswap V1 protocol uses a “constant” product making formula: xy = k, that will effectively sell the asset that moves up in price to purchase the asset that moves down in price as demand changes. Unfortunately, given how AMMs function, impermanent loss is not a “bug” but a feature of the protocol that can act against the liquidity provider’s portfolio growth.

(Above) An example of impermanent loss where fee revenue is less than absolute price change.

However, impermanent loss can actually be used productively to rebalance one’s portfolio as an asset increases in value. A participant may want to accumulate ETH when its USD value drops below a certain price and sell it above a certain price, while accumulating trading fees along the way.

Uniswap V2

Uniswap V2 went live on May 19, 2020. While V1 pioneered the standard for on-chain token swaps, its second version focused on efficiency and function with the goal of making Uniswap more accommodating to users and their needs.

One key improvement was a price oracle feature that provided users with enhanced visibility into the price actions of popular trading pairs. The price oracle allowed for a better user interface and helped begin to gain a grasp on decentralized exchanges.

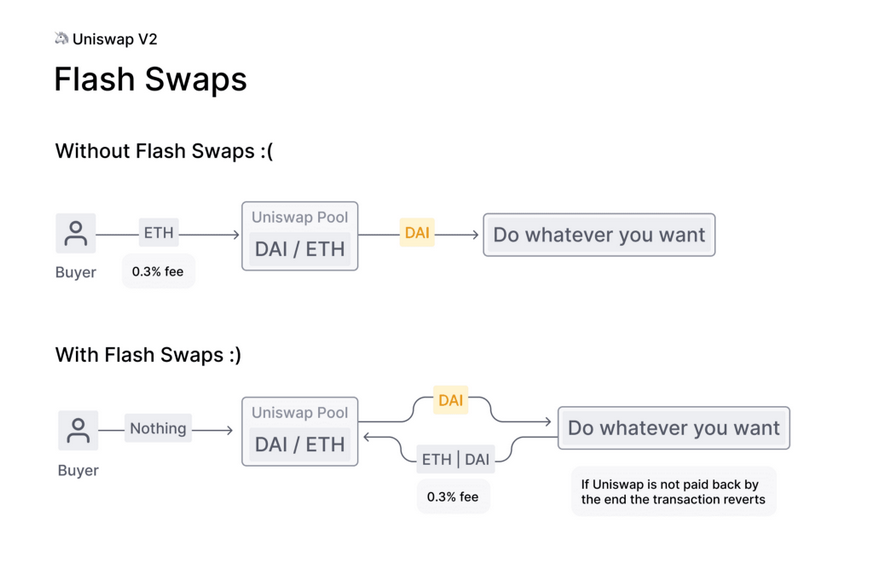

Flash Swaps.

Because Ethereum processes transactions in an atomic fashion, transactions can be reverted if some condition is not met. Flash swaps take advantage of this property to first send output tokens from trades before all input tokens have been received. This was an extremely integral feature of V2 and allowed for many new DeFi innovations to be born. In Uniswap V2 the concept of flash swaps allowed users to withdraw any amount of ERC20 tokens without having to pay an upfront cost. Users could either pay for the tokens withdrawn or pay for a portion and return the rest or return all the withdrawn tokens. Either action can be completed at the end of the transaction execution.

While Uniswap V1 only allowed for ETH to ERC20 swaps, V2 took a step back from the mandatory Ether peg and made all swaps between ERC20 tokens. While this may sound trivial, it served as a fundamental change on the protocol level. Users could now easily store capital in stable coins, wBTC, or wETH (because ETH is not an ERC20 token, the “w” stands for wrapped). A wide range of units of accounts could be used to seamlessly swap into a new token.

On the efficiency front, Uniswap routes traders to the most suitable liquidity pool according to the number of pairs.

These features all served the main purpose of V2, which was to create a better user interface, draw more users, and onboard more people into the DeFi world.

Uniswap V3

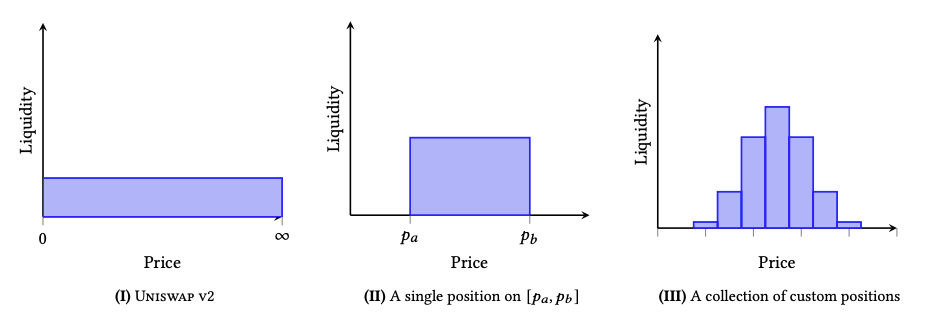

The core development presented in V3, concentrated liquidity pairs, results in a new interface that is fundamentally more “expressive” than the previous version of Uniswap. This “expressiveness” has four important properties: capital efficiency, active liquidity, range orders, and non-fungible liquidity pairs. The implications of this development also extend to Ethereum’s core ideological axioms, since concentrated liquidity state may favor a less distributed architecture as mediated by optimizing market dynamics.

Concentrated Liquidity and Capital Efficiency

In versions one and two of Uniswap, liquidity was evenly partitioned between zero and infinity. However, this liquidity distribution can be viewed as inefficient because most transactional volume happens close to current price action. To solve this problem and make the protocol more efficient, Uniswap V3 allows its users to bound their liquidity positions (“Concentrated Liquidity”). The aggregation of many different liquidity provider positions creates a distribution of liquidity around price.

Theoretically, if liquidity providers are both rational and update their liquidity positions as price moves, this should result in greater capital efficiency, facilitating more trading volume with less total liquidity locked up.

Non-Fungible Liquidity

An important note about these trading pairs is that they are permanently represented as an ERC-721 token (NFT) on the blockchain. This means each time a user creates a new liquidity position on V3, an NFT is created with the specified parameters. Once a liquidity pair is established, the bounds of the pair can not be changed. However it is still possible to remove liquidity from the pair and reallocate that liquidity to another ERC-721 pair. By keeping liquidity in a bounded range, Uniswap V3 created definite pools to facilitate trades. As more liquidity providers choose to create upper and lower bounds, slippage from trades becomes negligible

Active Liquidity

Another way to describe the effect of concentrated liquidity is that when price moves outside your liquidity’s price range, your position will be entirely composed of the less valuable of the two assets. In essence, the risk of impermanent loss is magnified in V3. Therefore it is necessary to monitor your position and continuously adjust your allocation to that pair. The notion that liquidity can be “in range” or “out of range” based on the current trading price is referred to as active liquidity.

Range Orders

Based on what we know about active liquidity, a participant may want to use this to discreetly allocate from one asset to another asset through a given price range. This is known as a range order, and it is constructed by establishing a one sided liquidity pair for an asset outside the current price range. Once market action moves price into that range, their position will be converted from their one asset to another asset in a smooth continuous transition. This effectively acts as an integration of multiple limit orders.

Further Implications

Concentrated liquidity is largely a positive development for the platform because it increased the internal productivity of Uniswap. However, V3’s implications for decentralization and distribution are not as straightforward. V3 places an emphasis on finding the optimal pool distribution for a given time by letting liquidity providers profit in proportion to the extent their liquidity was used. An optimal approach is going to concentrate liquidity in price area for a given time interval.

In a competitive environment, winning strategies must be reallocated as often as possible. Given gas and other resource costs, this means that many users who would like to provide liquidity individually are incentivized to delegate to an institution or a bot.

By making the structure more efficient, we are incentivising fewer parties to specialize in liquidity provision, and potentially pushing participants to delegate. Ultimately these developments could pose issues for decentralization, depending upon the way in which participants delegate.

Conclusion

As Ethereum and its ecosystem continue to evolve, it is important to balance decentralization with market efficiency. Because Uniswap lies at the heart of Ethereum as the leading DEX, it has a responsibility to pursue the implementation of these ideals. The ability to transact between different tokens without censorship is a necessity for any sufficiently decentralized ecosystem. It was Uniswap’s decentralized and distributed architecture that led to its utility and effectiveness as an institution.

Hayden Adams attributes a lot of Uniswap’s success to its decentralized architecture. In his view, centralized exchanges are like media agencies, while Uniswap is like Youtube or Twitter because its product relies on user generated content for its utility. Social media did not decrease the relevance of media agencies — it simply shifted and expanded the market. Digital technology extended the definition of media past that which traditional organizations could manufacture. Uniswap and other DEXs have the potential to serve as key instruments in redefining society’s relationship with finance, trade, and value accrual.

The fundamental value of Uniswap lies in its ability to host and facilitate frictionless interactions between ERC20 that are in demand. Without imposing an implied valuation, it is possible that Uniswap has only captured a fraction of its potential market. Its success is not only predicated on the notion of permissionless demand to facilitate liquid entry into “hype” coins, but on the assumption that centralized exchanges will be unable to list demanded token pairs at the market demanded rate.

The Boiler Blockchain team will continue to investigate the dynamic world of DEXs and provide updates to the above analysis as necessary.

***

Contributors: Matt Farrow, Will Delaney, Max Moncaster

***

References:

Uniswap Team. “A Short History of Uniswap.” Uniswap Protocol, 11 Feb. 2019,

https://uniswap.org/blog/uniswap-history.

Uniswap Team. “How UNISWAP Works: Uniswap.” Uniswap RSS,

https://docs.uniswap.org/protocol/V2/concepts/protocol-overview/how-uniswap-works.

Ryan Sean Adams, David Hoffman, and Hayden Adams. 59 — UNISWAP | Hayden Adams — YouTube. 22 Apr. 2021, https://www.youtube.com/watch?v=uQS7WuQtXWs.

Direr, Alexis. A Primer on Constant Product Matching Markets — Leo-Univ-Orleans. 28 Sept. 2020, https://gdre.leo-univ-orleans.fr/direr/paper/Uniswap_v2.pdf.

END